It comes after the grandchildren took the case to court.

Preparing a will can be quite troubling, there are people that you are expected to include and maybe an expectation of how much you are meant to leave to each person.

The idea behind a will is that nobody is left squabbling over who gets what, but the irony of it all is that it’s your last real chance to let people know how you feel.

This grandfather appeared to do this exactly, leaving his five grandchildren just £50 each of his fortune worth a whopping £500,000.

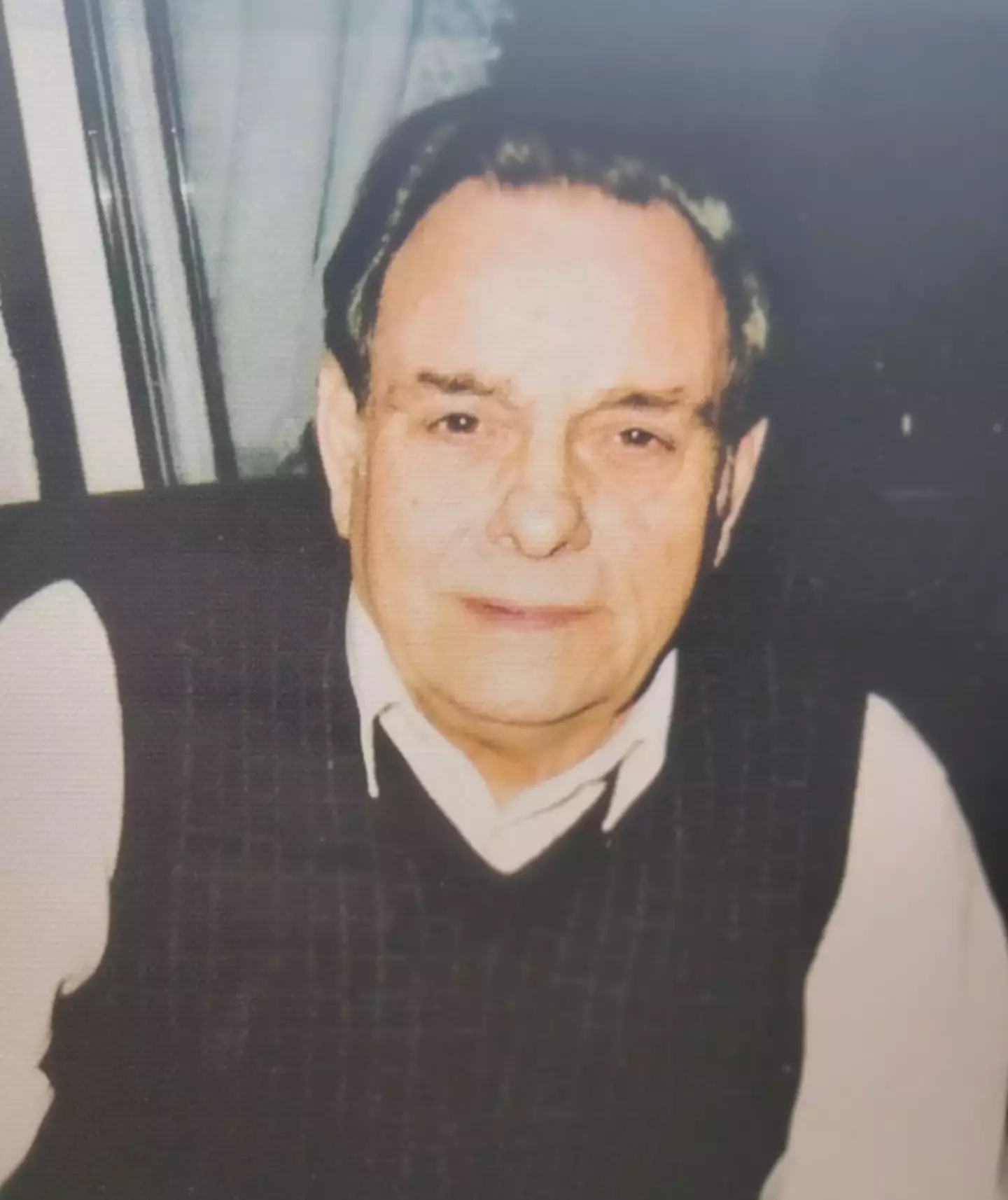

Former British soldier Frederick Ward Sr had his family arguing over his assets following his death in 2020, as his son Terry Ward and daughter Susan Wiltshire were left the majority of his fortune, leaving virtually nothing to the kids of deceased eldest son Fred Jr.

Champion News

At the time, the 91-year-old informed lawyers that he was hurt that his grandchildren didn’t visit him on any of the three occasions that he was in hospital with a lung condition.

Upon finding out that they were left out of the bigger parts of the will, grandchildren Carol Growing, Angela St Marseille, Amanda Higginbotham, Christine Ward and Janet Pett took the case to court.

But the mother of the five grandchildren, Ann Ward, has seemingly addressed the matter for the first time.

A close family source has spoken to the MailOnline, saying: “Ann is very clear. If her late husband was still alive he would have been absolutely fuming that his daughters had been disinherited like this.

“He would be turning in his grave.

“She has no doubts whatsoever about that.”

The source also claimed that it wasn’t about the money, as the women were only fighting for what their deceased father would have wanted and what they were initially promised.

They continued: “There are a lot of serious questions to be asked about the judge’s ruling.

“Ann believes some key evidence appears not to have been fully taken into account.”

The source also claimed that the sisters ‘can’t afford’ to appeal as they are paying both sides’ legal costs.

Champion News

Despite taking it to court, High Court judge Master James Brightwell ultimately ruled that the will, which was written in 2018, was based on rational grounds.

These grounds were that they had limited contact with their grandfather in his final years.

He remarked: “Some may take the view that, as a general proposition, when a testator’s child has predeceased him, he generally ought to leave an equal share of his residue to that child’s issue.

“However, the decision not to do so and to split the residue and thus the bulk of the estate between his surviving children can hardly be said to be provision which no reasonable testator could make.”

After the sisters claimed that their aunt and uncle had ‘unduly influenced’ their shares of the fortune being removed, a recording of Ward’s will reading was played to court in which a row between the family could be heard.

Master Brightwell concluded: “In those circumstances, and despite a promise by Fred several years earlier to divide his estate between his children’s children if anything should happen to any of them, the 2018 will was in my view entirely rational.

“This does not mean that I cannot understand the claimants’ disappointment at being essentially left out.”

Warning to Revolut customers after £200k stolen from two accounts and they didn’t get it back

Scammers are targeting Revolut customers

A warning has been issued to the millions of people who now use online banking service Revolut after £200,000 was stolen from customers.

With over 30 million users, the London-based neobank offers its services to both ordinary folk and businesses. As well as banking it offers currency exchange, debit and credit cards, stock trading and even crypto.

But the company has had to issue a stark warning to its customers after hundreds of thousands of pounds was nicked from a couple of accounts.

The money was stolen from two business accounts via unauthorised access, taking the money out of the accounts and transferred to HSBC accounts before Revolut detected the breach.

One account had £165,000 taken, rendering the business on the brink of bankruptcy, Which? reports. The other breach saw £40,000 stolen in just 10 minutes.

The money will not be given back to the customers by Revolut, the bank has said, as multi-factor authentication checks were completed. But it will be strengthening its cyber security policies going forward.

The man running the business that was gutted of £165k told Which? he was called on a private number by someone purporting to be from Revolut’s fraud protection team.

JUSTIN TALLIS/AFP via Getty Images

He said: “The caller says they are from the Revolut fraud protection team and explains that there have been suspicious transactions on my account. They think my account has been compromised.

“Initially, they ask quite a lot of questions, about anyone having access to the account. No one else did have access. Throughout the call they applied pressure and kept passing me to different ‘departments’ in the company.”

No phone call arrived, instead he was emailed from Revolut to confirm login from an unknown device.

The businessman was told to reply to this request with the words ‘block request’ before removing and then reinstalling the app. This triggered a security code sent by text, which he shared to reset his security details.

But the reality of the situation was that these steps gave the criminals the ability to pass one of Revolut’s security checks, though it remains entirely unclear how they were also able to provide the ‘selfie’ photo that enabled them to take over the account.

A Revolut spokesperson said: “We are sorry to hear of (these) cases and any instance where our customers have been targeted by ruthless and sophisticated criminals. Each potential fraud case concerning a Revolut customer is carefully investigated and assessed independently of other cases. We are aware of a recent increase in advanced Account Takeover (ATO) scam attempts by criminals across the industry.

“We are continuously strengthening our fraud controls to stay one step ahead of this trend, introducing further direct interventions and sharing educational materials with our customers so they are able to spot the social engineering tactics of criminals.”